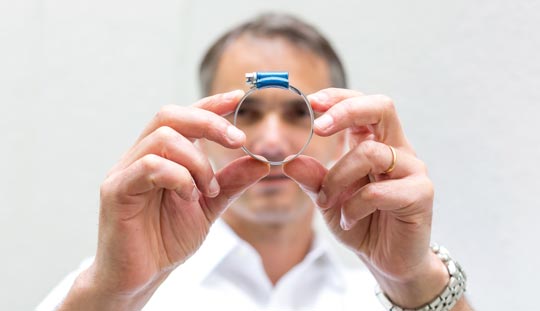

NORMA Group has experienced a sustained period of strategic acquisitions and growth, which has seen its global network expand to 22 production sites and multiple sales offices. Now NORMA has announced the restructuring of its core brands to simplify a product portfolio of around 35,000 high-quality joining products.

We spoke to Florent Pellissier, vice-president global marketing, about NORMA Group’s acquisition philosophy, the strategy behind the brand restructuring, and the Group’s plans for the future:

What has driven NORMA Group’s acquisitions and what have they brought to the Group?

“Over recent years NORMA Group has grown by acquiring several companies throughout the world, resulting in a global portfolio of more than 21 brands. This has enabled the Group to not only broaden its product portfolio, but also to extend its customer base and increase its geographic presence.

Why was it important to reposition your brands?

“Brands are like lighthouses. They help customers get their bearings. They show them what they can expect for their money. Customers trust brands when it comes to making a decision. In a world where products are very similar and interchangeable, the brand represents a way of standing out from the crowd, emphasising the product’s strengths and benefits, and underpinning a reasonable purchase price. As a global supplier of engineered joining technology, NORMA Group is more of a specialty brand. But the same thing that applies in the consumer world also applies to us – customers trust strong brands. They know what they stand for and are willing to pay a price that is commensurate with the promise of quality. That enables strong brands to compete successfully and make them more crisis-proof in difficult times. In this respect NORMA Group definitely has a lot to offer. But we want to make the benefits that our branded products offer even more visible for our customers. Therefore we needed to work hard to reposition our global brands to create a harmonic overall view of all products we offer to the market.”

What did the process entail and how have the brands been grouped?

“Initially we carried out a survey of our customers and employees, which made it clear that there were gaps in the perceptions and expectations with regard to the Group’s twenty-one different brands. The poor profile of certain brands even had a negative impact. We created a brand strategy that closely evaluated each brand – focusing on specific topics. These included: What is the story behind each brand? What does the brand stand for and are its claims sustainable? Which profiles need to be honed? Which brands need to be repositioned and which brand names are outdated? As well as which products might sell well under another brand?

By focusing on our key brands with clear product allocation, we are now able to offer a very comprehensive range of clamping and connecting products that meet any needs the market may require – whilst still keeping safety and innovation firmly in focus. True to the motto ‘act globally and think locally’, the new brand universe was adjusted with regard to the conditions and customer expectations. This is why regional brand concepts were developed. What they have in common is that all brands go under the NORMA Group umbrella brand. ABA®, NORMA® and GEMI® products fulfil very specific quality propositions in different price ranges throughout the world. In addition to this there are single brands only available in specific regions. Some brands have merged into other brands. Globally, a total of seventeen brands remain out of the original twenty-one. In EMEA we are represented by the NORMA, ABA and GEMI brands in all countries. These three brands meet different customer needs with regard to price, performance and product. Two exceptions to the rule are the French brand Serflex™ and the British brand Terry™. In the French regional market we still sell Serflex, a brand that is so well established there that it is practically a synonym for worm drive hose clamps. Terry is related to brand history, new selling opportunities, and a highly competitive environment. Other regional brands such as Serratub™ in Italy have been discontinued, but production and the products continue under one of the three main brands. The relaunch also includes some revised logos and associated colours and imagery. We have also revised all of our sales and advertising materials for the brand relaunch. We now have new catalogues, advertisements as well as new brand microsites.”

What does the brand repositioning mean for the customer? How will it enhance the level of confidence and commitment customers should have in the brands?

“The repositioning of the brands is bringing clarity to our broad product offering. Our flagship brands are what they are because of their strong history path over recent decades. Revitalising those core values is what this repositioning is all about. With the fast growth NORMA Group has experienced during the last few years, we’ve seen a tendency of having certain brands melting into each other, confusing our customers. We want to have a clear product and service offer, to make it easy for our customers to find the right products and solutions for their needs. So a well defined product range, showing product performance and also services, has been the key to restructuring our brand portfolio.

How has the demand for your extensive product portfolio changed over the last 10 years? What are the factors driving these demands?

“The fast growing pace of NORMA Group over the last ten years has made it difficult for customers to know what the specific brands stood for and how they precisely differed from the company’s other brands. That is why we listened to our customers – one of the most critical factors that led to the change. Whatever we can do to remove complexity in doing business with us contributes to our growth. Having a clear understanding of the service and products you get when buying a certain brand is critical.

What technologies and knowledge have you developed?

“An important parameter for conducting business successfully is market knowledge. Without this market intelligence, you just remain a commodity supplier bringing no added value to your customer. Being present in so many markets and channels, as we are, gives NORMA Group a lot of competitive advantages. For example, we can apply the technologies, or part of them, that we use for OE markets to other kind of products more suitable for distribution or aftermarket – making our product offering more competitive.”

Will joined Fastener + Fixing Magazine in 2007 and over the last 12 years has experienced every facet of the fastener sector – interviewing key figures within the industry and visiting leading companies and exhibitions around the globe. Will manages the content strategy across all platforms and is the guardian for the high editorial standards that the brand is renowned.