With the highest number of registrants to date, Afera’s 5th webinar in its Covid-19 lockdown exit series explored strategic reconsiderations of supply chain goals, zeroing in on continuity, transparency, sustainability and flexibility.

Titled “Considerations about localising and shortening the supply chain in Europe”, 69 Afera member company delegates tuned in to exchange experiences, know how and best practices on this unique community platform.

“The biweekly Afera webinars of the past two months have been highly appreciated by our members,” commented the Association’s Secretary General, Astrid Lejeune. “The opportunity to hear about the challenges, solutions and considerations of industry peers regarding specific business topics is extremely valuable in future-proofing their businesses.”

Evert Smit, Afera president and head of R&D at Lohmann GmbH & Co. KG added: “The popularity of Afera’s webinars clearly shows the value for members of being part of this dedicated industry community. After all, Afera is a unique network in which to exchange with our industry peers within the European tape industry, and it shows its strength now maybe more than ever.”

During the webinar, Afera Regulatory Affairs Manager Pablo Englebienne described the continuing process of exiting Covid-19 lockdown in most European countries. In the meantime, major outbreaks have been localised in Latin America, Asia, and Africa, where it is just beginning to spread.

Also discussed was ‘Next Generation EU’. The European Commission has proposed a recovery instrument, ‘Next Generation EU’, with the goal of repairing the social fabric of Europe after the Covid-19 crisis, while at the same time protecting the single market and helping rebalance the financial sheets of the different Member States and affected industries.

Another big topic was the automotive industry, which has been greatly affected by Covid-19 disruption. It is one of the largest markets for the European tape industry. The Spanish multinational Gestamp, which specialises in the development and manufacture of metal components for the automotive industry, is receiving a €200million loan from the European Investment Bank (EIB) to develop new research lines, enabling the production of safer, lighter and therefore more environmentally friendly cars. Mr Englebienne said that he hoped to see the creation of more E.C. measures for this industry, which employs 14 million people in Europe.

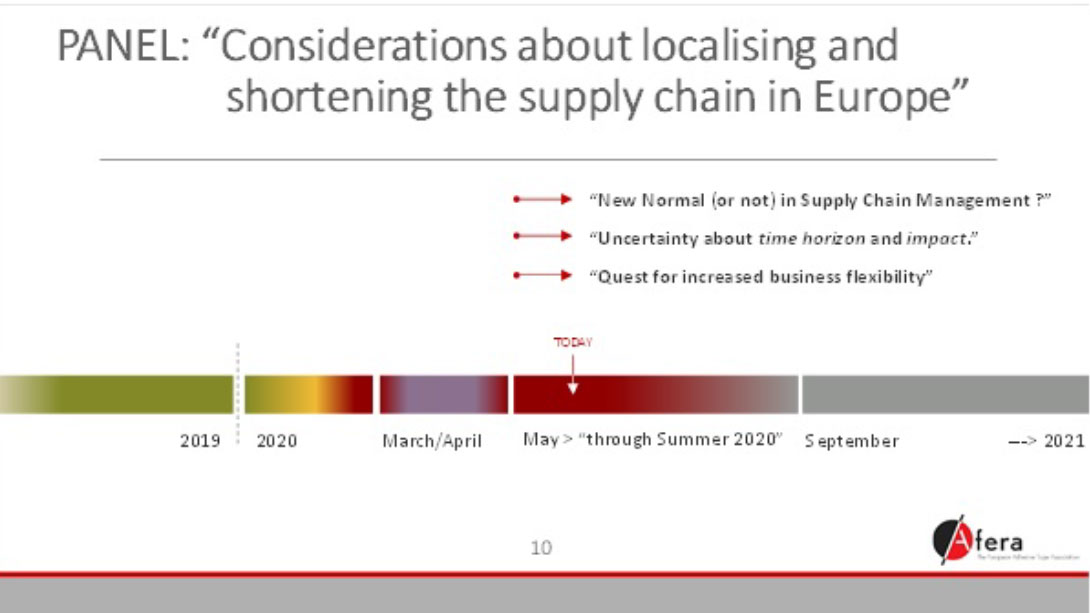

Also during this webinar, four tape industry leaders described the acceleration of a pre-existing trend toward localising and shortening of supply chains. Melanie Ott, global business manager of tapes and labels at H.B. Fuller described, from her global sales perspective, that some customers are currently ordering more locally, instead of the usual trend to buy in Asia or other regions outside of Europe. “I think, however, that at the moment it is a bit too early to say if this is a really sustainable trend or a short-term reaction to actual supply issues,” she said.

Laurent Derolez, chairman and CEO of Novacel S.A., commented: “I think the Covid-19 situation has caused prices merely to amplify the pre-existing trend towards onshoring. Before things were moving a little bit in this direction, and now they are accelerating.” An early proponent of onshoring, having driven Novacel in this direction after the global financial crisis hit in 2008, Mr. Derolez explained that: “We all want our suppliers close to us, because it is easier to forge partnerships requiring highly technical communication with someone who lives 500km away versus 5,000 or more.”

Philip Guy, general manager for tape solutions at Saint-Gobain S.A. said: “The shortening of the supply chain is something that has been going on, especially with our customers. We have been localising through our customers as much as possible, and along with that, we plan local raw material resourcing as much as we can.”

Nitto EMEA President and CEO Sam Strijckmans went on to describe what he sees as ‘turning back the globalisation of the business’, some industries are moving back to Europe. “For a long time, the semiconductor business was moving over to Asia, but over the last few years, we have seen very big investments made in Europe in this segment,” he explained. “Another example is battery production in Europe. There are many on-going investments in this segment that will provide a lot of opportunities to the tape industry in Europe again.”

Ms. Ott commented: “The highest general priority of companies at the moment is security of supply. While some companies want to achieve this by choosing for a local supply, others feel that merely using more than one supplier, so having 2 or 3 as backups to spread their risk, is the best way to ensure continuity.” Others say that building and maintaining long-term relationships with suppliers is key, meaning there are a few different ways to approach this.

The ‘baptism by fire’ digital strides being made will go hand-in-hand with increasing transparency in the supply chain. The pressure of digitisation can be seen as an opportunity to make supply chains better industry-wide while maintaining individual competitiveness. “This is being discussed in blockchain technology, for example,” suggested Mr Strijckmans. “So if the exchange of data becomes increasingly transparent, we will be able to make more logical decisions in terms of supply chain.”

Mr Guy added: “Digitisation will enable us to shorten our supply chains, because there will be more accurate information on how to source raw materials needed to deliver technical performance required within our products. The more open we are, and the more digital we are in terms of being able to share some of that information with our supplier businesses, the more we will be able to manufacture similar products in similar regions.”

The other thing that is fuelling the shortening of supply chains is the ever-increasing flexibility from industry customers. Mr Guy said that those he works with want less-standard products, and in order to meet this demand, you need to have as short a supply chain as possible. “In simple terms, you are stuck buying such large quantities and bringing them across continents, so the more you can do that is localised; the more flexible you can be to your customers, the smaller the quantities you can work with,” he explained.

Mr Guy also pointed to the adverse environmental impact of the energy consumed in moving materials across continents. He feels the shortening of supply chains will continue because of the green nature of it. Saint-Gobain has made a pact to be carbon-neutral by 2050. “Some of the materials produced in adhesive tape manufacturing require a lot of energy. Looking at the whole lifecycle of the materials, at our suppliers and reducing the actual physical length of those supply chains, will help in reducing the energy being used to make those products.”

Finally, Bert van Loon, moderator and marketing strategist, asked: “At present, what is your biggest priority for the next 6-12 months, if you had to pick one?”

Mr Guy answered: “I feel that sustainability is most important in the long run, but in the timeframe you are talking about, I would say flexibility. This is something that is being driven by our customers, who want us to be much more flexible with our materials, so we need a supply chain that is much more flexible.”

Agreeing that the topic of sustainability would remain high on every European company’s agenda, Mr Strijckmans said that many customers are guaranteeing the supply chain and the speed of delivery, and many companies are concentrating heavily on cash flow. “This means that they want small orders faster, but less stock on hand to be able to manage their cash flow; so in that sense speed and flexibility are the short-term priorities, together with quality and service, of course.”

Mr. Derolez concluded: “I think if you do not look after your short-term, you will not see the long-term. We all find ourselves in exceptional circumstances, so short-term should definitely be the focus.”

The recording of the 28th May webinar is now available, using the password 1J+l=c$8

Register for the next webinar

Afera’s next exclusive webinar in its lockdown exit series ‘Navigating the Covid-19 crisis within the adhesive tape value chain’ will cover ''Innovation: lessons learned from the first months of Covid-19 disruption". A 7th webinar discussing “Sustainability and business recovery in the new normal” is also scheduled to follow.